In an age dominated by information and innovation, the most valuable assets of a business are no longer just physical structures or tangible resources. The economy has evolved from transforming raw materials into physical products towards a technology-led society where intangible assets such as brand names, patents, proprietary software, and customer relationships are now the lifeblood of businesses and the currency of success. As such, part of determining the value of a business is through intangible assets valuation.

At BSO Fintax, we frequently engage with clients for whom this is a reality. Our valuation experts are often asked to provide an assessment of the value of intangible assets, including ideas, designs, and processes leveraged by businesses daily. For many companies, both new and established, evaluating intangible assets has become a complex puzzle, demanding innovative valuation methodologies to unlock their true potential. This article introduces intangible assets, their treatment under UK accounting principles, and when a formal valuation might be necessary.

What are Intangible Assets?

Intangible assets refer to non-physical assets that hold significant value for businesses. These assets are non-monetary resources and rights contributing to a company’s competitive advantage, market position, and overall value. Unlike tangible assets such as buildings or equipment, intangible assets include intellectual property (IP), brand recognition, patents, copyrights, trademarks, proprietary technology, customer relationships, software, licenses, and goodwill.

Despite their intangibility, these assets are critical drivers of innovation, growth potential, and business success. They create unique advantages, such as market disruption, barriers to entry for competitors, customer loyalty, and the ability to differentiate products or services.

Valuing intangible assets poses a complex challenge as their worth often lies in their potential to generate future economic benefits, rather than present market value. Recognising and properly accounting for these intangibles is essential for accurately assessing a company’s overall value, facilitating informed decision-making, attracting investment, and understanding the true potential of a business in a knowledge-driven economy.

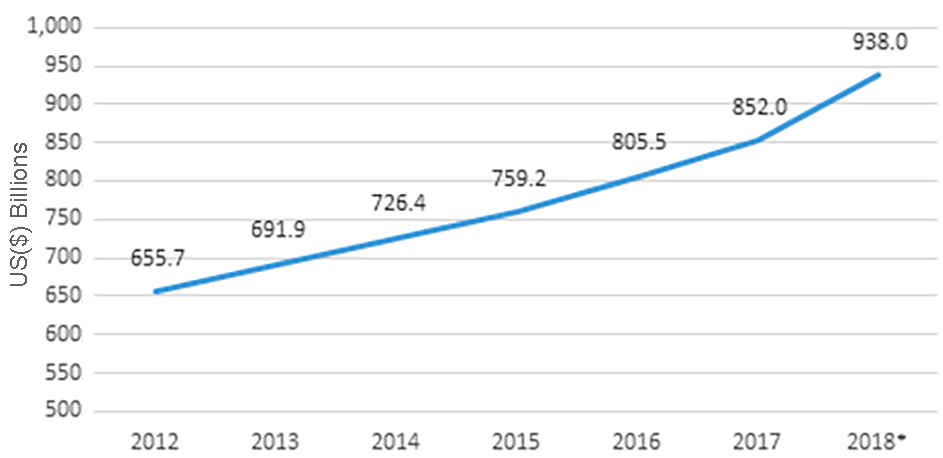

Intellectual Property Products Investments

How are Intangible Assets Accounted For?

A company’s ability to recognise intangible assets depends on the accounting standards it follows. UK-based companies typically adhere to FRS 102 or IFRS standards. These standards require specific criteria to be met before internally generated intangible assets can be recognised on the balance sheet, such as demonstrating probable future economic benefits and reliable measurement criteria.

FRS 102 vs. IFRS

- Research Phase: Expenditures incurred during this phase, such as research and analysis of new processes or products, are recognised as expenses in the profit and loss statement (P&L).

- Development Phase: Costs associated with developing an intangible asset can be recognised on the balance sheet during this phase. This includes designing, creating prototypes, or developing infrastructure to support the launch of a new product or service.

FRS 102 provides more flexibility for recognising intangible assets on the balance sheet, provided these assets are separable or arise from contractual or legal rights. This grants companies some discretion in recognising their intangible assets, potentially enhancing the strength of their balance sheet.

Under IFRS, stricter criteria apply. The asset must meet certain criteria for recognition, such as reliable cost measurement, probable future value generation, and control over the asset. Costs incurred during the research phase are expensed, while development phase costs can be capitalised and recognised as an intangible asset.

When Might You Need a Formal Valuation?

Accurate accounting for intangible assets is vital for compliance and reporting. Beyond formal recognition on the balance sheet, there are instances where companies or shareholders may require a valuation of these assets:

- Disclosures: Supporting disclosure requirements in financial statements, particularly for impairment testing.

- Enhancing Intellectual Property Protection: Valuations support IP management, licensing, or transferring assets for protection and tax purposes.

- Transactions: Essential in negotiations for business sales or purchases, aiding in Purchase Price Allocation.

- Restructuring: Necessary for IP transfers, complying with Transfer Pricing requirements, and tax computations.

Professional valuation of intangible assets provides valuable insights, ensuring transparency, compliance, and fair negotiations.

Methods for Valuing Intangible Assets

Intangible assets valuation is often more challenging due to their unique and non-physical nature. However, several primary methods are used based on the market, income, and cost approaches. Here are the top methods:

- Relief from Royalty Method (RRM): Calculates value based on hypothetical royalty rates saved by owning the asset. Commonly used for trademarks and software.

- With and Without Method (WWM): Determines value by calculating the difference between cash flow models with and without the asset.

- Multi-Period Excess Earnings Method (MPEEM): Isolates cash flows associated with a specific intangible asset, discounting them to present value. Often applied to software and customer relationships.

- Real Option Pricing: Values assets with potential future cash flows, such as undeveloped patents, capturing the “time value” of these assets.

- Replacement Cost Method Less Obsolescence: Establishes a replacement cost new for the intangible asset, adjusted for obsolescence.

Valuing intangibles requires significant judgement. Using these methods, a seasoned valuation expert can calculate a defensible fair market value.

Conclusion

Understanding the value of intangible assets is crucial for businesses in today’s knowledge-driven economy. Proper valuation methodologies and professional expertise ensure that these assets are accurately reflected, facilitating informed decision-making, compliance, and strategic planning.

If you need assistance with the valuation of your intangible assets, contact BSO Fintax’s valuation experts. We provide accurate, defensible valuations and ensure your intangible assets are properly accounted for and leveraged to their fullest potential.